Car manufacturers in Europe have a clear pathway to comply with European Union clean car rules in 2025, which should see battery electric vehicles (BEVs) reach a market share of between 20 and 24 per cent next year.

According to a new analysis from Transport & Environment (T&E), Europe’s leading advocates for clean transport and energy, EV sales are expected to rise to 24 per cent market share, and help car makers meet the stricter European Union (EU) new car CO2 targets in 2025.

This analysis stands in stark contrast to many carmakers’ fears that sluggish EV sales in the last year will make it harder to comply with EU 2025 climate targets, leading them to call for a two year delay in the CO2 targets – a demand that has been described as “cynical and absurd” by T&E.

According to T&E, all carmakers have clear pathways to meet their EU climate targets in 2025, due in large part to the pending availability of seven “affordable” EVs under €25,000 (around $A41,000) which are already available or set to go on sale in 2025.

Carmakers in Europe are expected to mitigate their CO2 average – 93.6g of CO2 per kilometre for passenger vehicles between 2025 and 2029, and 153.9 g CO2/km for vans.

Volvo Cars is already compliant, while Kia is the next closest to the 2025 target, and Ford and Volkswagen are the furthest away from their targets with gaps of 28 and 29 gCO₂/km respectively.

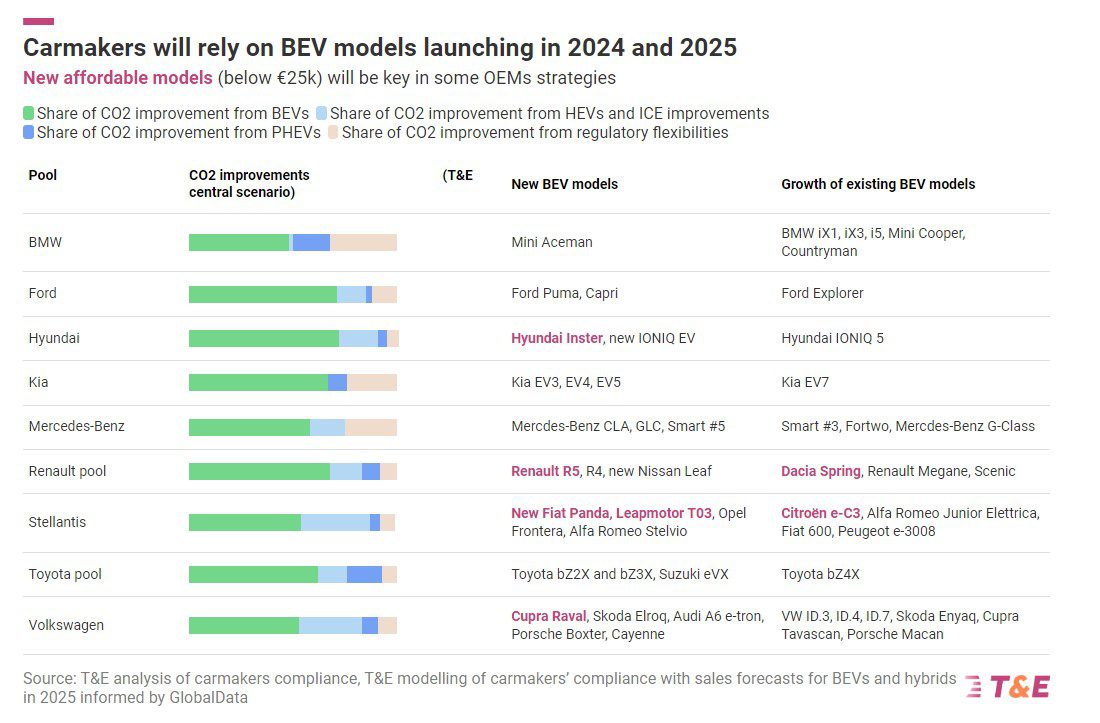

T&E expects an increase in BEV sales will contribute 60 per cent, on average, to the emissions reduction that carmakers need to achieve for the 2025 emissions target.

T&E further advises carmakers looking to meet their compliance targets to sell more hybrid vehicles, while nevertheless acknowledging that hybrids are not a “future proof option”.

For example, T&E predicts Stellantis and Volkswagen Group will rely on hybrids for 33% and 30%, respectively, of the CO2 reduction they still need to achieve the EU targets.

“2025 will be a great year for Europeans in the market for an electric car,” said Lucien Mathieu, cars director at T&E.

“BEVs should be almost a quarter of new cars sold thanks to a glut of new, more affordable models. But manufacturers’ reliance on hybrids, which are reaching the limits of their CO2 saving potential, is a short-sighted strategy for the climate and competing with Chinese BEVs.”

Meeting these short-term targets will be vital for carmakers aiming to stay relevant, after EU Commission president Ursula von der Leyen confirmed in July that the EU’s zero-emissions cars target will go ahead in 2035. The German government also recently rejected the car industry’s call to weaken 2025 targets.

“Now it’s time for the EU to support electric car uptake by setting electrification targets for corporate fleets,” Mathieu said. “Governments need to build a stable regulatory environment for EVs with national charging goals and targeted support for buyers.”

Joshua S. Hill is a Melbourne-based journalist who has been writing about climate change, clean technology, and electric vehicles for over 15 years. He has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven since 2012. His preferred mode of transport is his feet.