On April 6, Walmart announced that by 2030 it intends to build its own DC fast-charging network at “thousands of Walmart and Sam’s Club locations coast-to-coast.” This move by the world’s largest retailer has the potential to shake up the fast charging industry.

First, let’s look at Walmart’s existing DC fast charging footprint. As of April 6, 2023, using Alternative Fuel Data Center (AFDC) data, 285 Walmart/Sam’s Club stores had DC fast chargers. The majority of these fast chargers (98%) are operated by Electrify America, the second largest US charging network based on the number of charging ports.

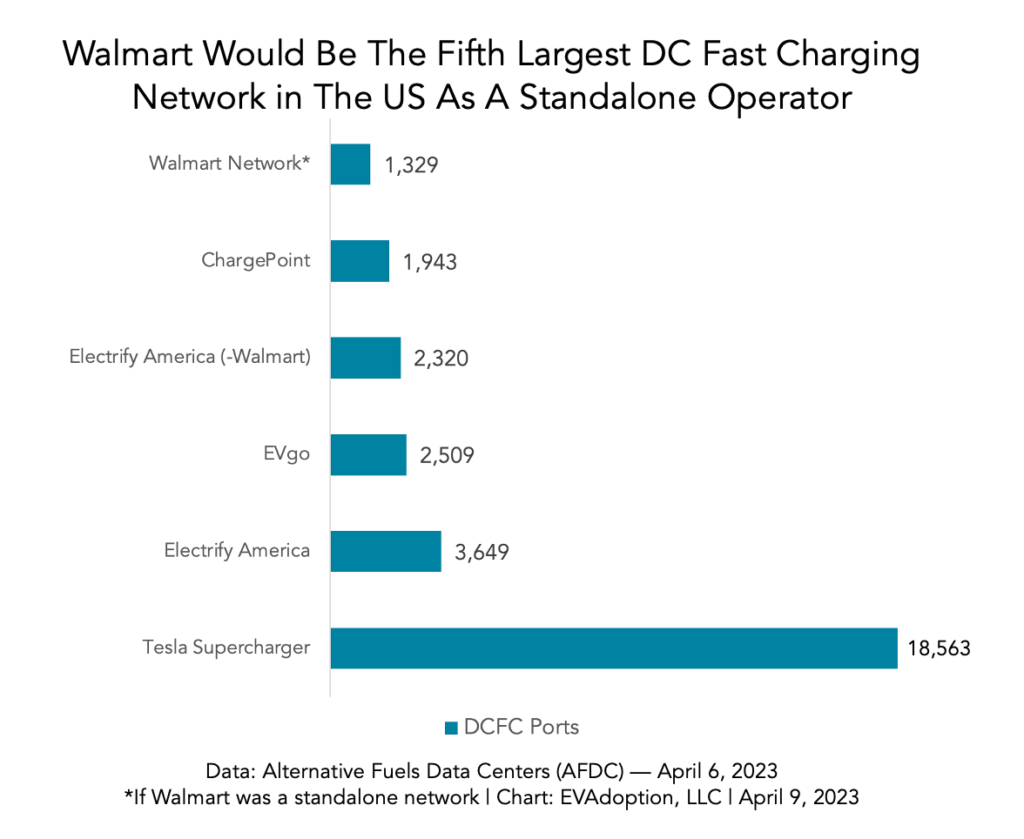

If Walmart/Sam’s Club converted (it likely can’t for many years due to lease contracts) all of their locations that Electrify America operates to the “Walmart network” overnight, it would become the fifth largest US DCFC network (based on the number of charging ports (connectors)).

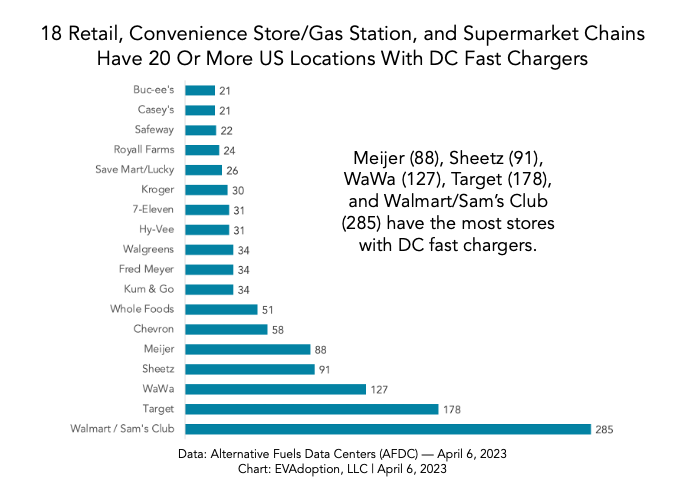

While Walmart intends to build out its own branded DCFC network across the US at its Walmart and Sam’s Club stores — the big-box retailer already has more stores (285) with DC fast chargers than any other retailer. Target has the second most with 178, 108 less than Walmart, and convenience store chains WaWa (127) and Sheetz (91) rank third and fourth.

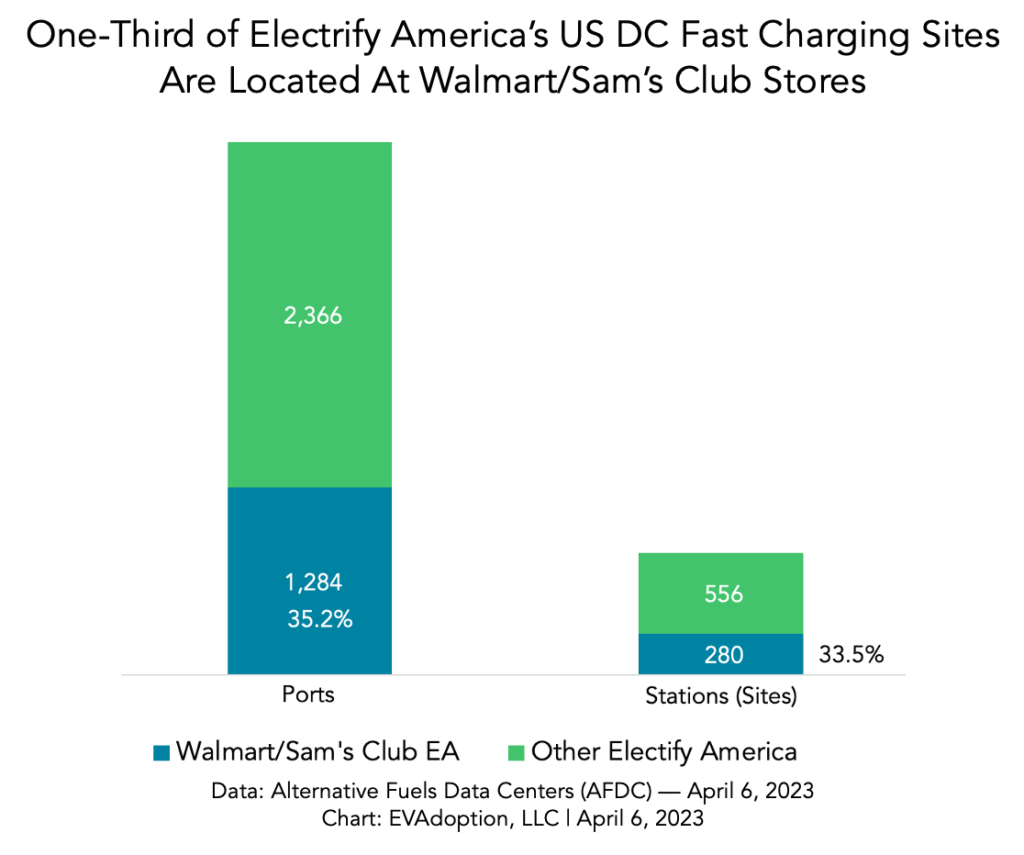

Lastly, Walmart/Sam’s Club locations account for more than one-third (33.5%) of Electrify America’s US fast charger locations and 35.2% of Electrify America’s total number of DC fast charging ports.

Implications of a Walmart Fast Charging Network

The chart above that shows the ranking of retailers’ locations (whether pharmacies, big-box stores, convenience stores, gas stations, and supermarket chains) are already one of the most popular sites to locate EV chargers. The reason is simple. Charging an EV is all about dwell time and doing something else such as eating or shopping while your car is parked and adding range. Most EV drivers don’t want to sit in their car while it charges, but put that time to good use, whether using the restroom and getting food and/or beverages such as coffee, or shopping.

There are at least seven potential implications resulting from Walmart’s announcement, including:

1. Other Retailers Launch Their Own Networks: I don’t expect most large retailers to build their own-branded charging networks, but instead continue to just be a site host for fast chargers operated by networks such as Tesla, EVgo, Electrify America, ChargePoint, and some of the smaller/regional charge point operators. Operating a charging network is just not core to a retailer’s primary business, so for most, it will make sense to continue adding chargers to their store locations — but leave the operations aspect to companies for whom it is their primary business.

But the Walmart announcement could also be a catalyst for other large retailers that are already in the “refueling” business — like Costco, Safeway, and Kroger — to get serious about EV charging. These retailers understand the refueling business, have utility and infrastructure teams in place already, and often tie their gas rewards programs to membership cards providing per-gallon discounts. For these retailers, EV chargers and electricity are simply an additional type of fuel and an opportunity to attract and reward loyal customers.

2. Convenience Store Chains Increase Deployment Plans and Pace: Convenience store chains including WaWa and Sheetz already are major players in DC fast charging, but primarily just as site hosts for Tesla Superchargers. However, both 7-Eleven and Circle K have launched their own branded charging networks and mobile apps – intending to be some of the largest charging networks in North America by the end of this decade.

The Walmart announcement could light a fire among leadership at these companies, revealing that they need to step up their game and the pace of their expansion. My sense is that while these leading convenience store chains have huge plans for EV charging, they are also somewhat conservative and methodical in their rollout plans. Business executives tend to monitor competitors closely and are frequently motivated by rankings and competitor moves. Don’t be surprised in the next year if some of the major convenience store chains announce increased target numbers for their fast charging networks.

3. Home Depot/Lowes Target Their Commercial Accounts: Walmart’s planned charging network could trigger a move by big-box retailers, such as Home Depot and Lowes, propelling them to build a fast charging network at their stores (to be designed especially for their commercial accounts – where they will increasingly add electric trucks to their fleets). Many of these companies will have trucks that pick up supplies at Home Depot or Lowes several days per week, making it ideal for these companies to charge their vehicles while employees are inside purchasing supplies. This could reduce reliance on the costs involved in building out their own fleet depot charging stations and further increase their confidence in going electric.

Home Depot/Lowes might also offer free or discounted charging to commercial accounts that spend above certain monthly thresholds since it is easy to spend 30+ minutes at the store.

4. Charging Price Wars: Walmart has tremendous pricing power and is known for its “everyday low pricing.” And in fact, the press release from Walmart confirmed that they will offer low-price charging, perhaps the most competitive pricing per kWh in the industry.

And in line with our purpose, we aim to offer Every Day Low Price charging –

helping ease transportation costs.

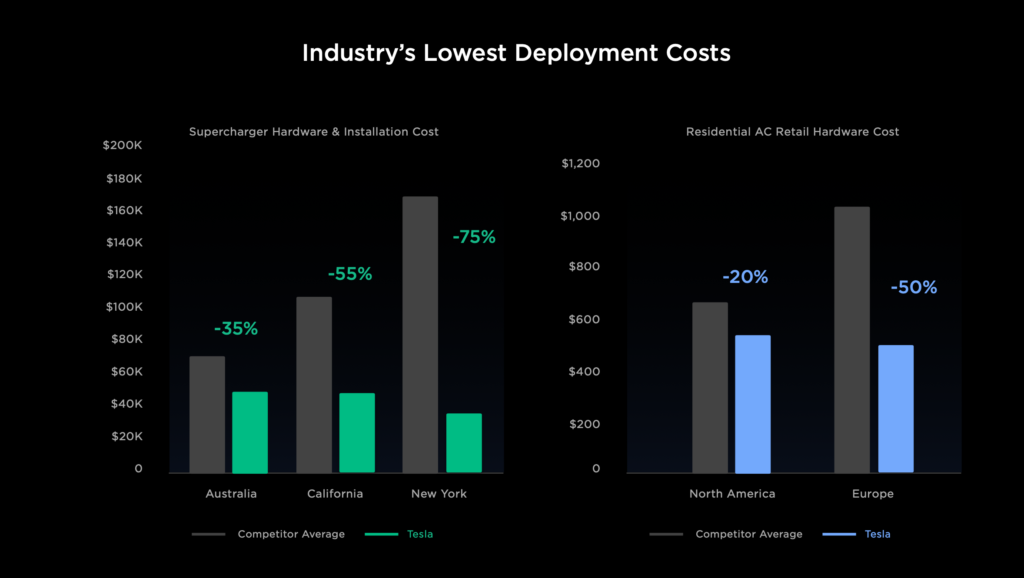

The DC fast charging business is generally considered a crappy business (for now) due to the high deployment costs (from $110,000 to $250,000 per charger depending on power levels and other factors), relatively low utilization, and the high cost of electricity during peak hours of the day. But large retailers like Walmart will likely be able to reduce deployment and operations costs as Tesla has done, claiming charger deployment costs that can be 25% to 50% that of other networks. If charging networks price DC fast charging at say $.50 per kWh, but Walmart launches at $0.35 — the other networks will likely have to respond and lower pricing.

5. Potentially Dissuades Nearby Businesses and Apartment Owners From Installing Chargers: One potential downside of Walmart’s charging plan is that nearby businesses, especially apartment complexes, may choose not to install chargers at their own locations. Some apartment owners (many of whom are reluctant to invest in EV chargers) with properties located near a Walmart or Sam’s Club with chargers, may simply tell their EV-driving tenants to “charge up at Walmart.”

Anecdotally, I’ve seen this in some apartment tenants in the Bay Area who rely on chargers at nearby hotels or Target locations. On the positive side, apartment dwellers who are considering buying or leasing an EV but don’t have access to a charger at their apartment complex may end up buying an EV knowing that they can charge at the nearby Walmart.

6. Increased NEVI Competition: The Walmart press release did not mention applying for state NEVI grants, but Walmart and Sam’s Club locations will clearly qualify for many of the Alternative Fuel Corridor (AFC) locations in many states, as well as suburban/urban locations in the second phase of NEVI funding once AFC locations are built out. State DOT/DOE decision makers would look very favorably to awarding NEVI grants to Walmart, believing they would provide a great customer experience, competitive pricing, and likely to keep chargers well maintained.

7. Charging Networks Transform Their Business Model: Instead of being the face of the charging network, many of the national and regional charging networks may increasingly focus on “powering ” retailers’ charging networks — akin to the infamous Intel Inside branding and model.

EVgo, in fact, has launched its EVgo eXtend brand and concept. Under EVgo eXtend, they install, operate, and maintain DC fast chargers for retailers and travel centers/truck stops, such as Pilot and Flying J, where they will install, operate, and maintain 2,000 fast charging stalls. And Electrify America, through its Electrify Commercial division, is partnering with retailers like IKEA to build out charging solutions for their fleet delivery vans and consumer shoppers. While this approach may provide less upside, in the near term it provides significant additional revenue for these charging companies and less risk.

Walmart has thrown down the gauntlet, and the race is officially on to see which retailer will have the most stores and total chargers by 2030. I suspect Walmart will be #1 and that numbers two and three will likely be convenience store chains/gas station operators. Regardless, Walmart’s entry into the realm of fast charging cannot be underestimated.